The home-buying process is complicated and even the most prepared have regrets. Here are some of the things people regret overlooking after buying a home.

10 Things You’ll Regret Overlooking when Buying a Home

Future Development

When you have a specific house in mind, think about potential developments. For example: If the home is near a busy road, will there be expansion in the near future? If there is a lot of open space around the home, will more homes be built in the area soon?

It may be difficult to find concrete information about future developments, but keeping some what-ifs in mind as you look can help you find your ideal home. Also, keep in mind the potential resale value of your future home because no one knows what the future holds and you may need to sell earlier than you imagined.

Forgetting Pre-Approval

If you’re serious about buying a home and not just trolling the market, be sure to get pre-approved by your bank or credit union BEFORE you start viewing homes. It’s one of the key lessons people wish they knew before buying a house. And be sure to obtain pre-approval instead of just pre-qualification, which is simply a preliminary letter from your bank without the official credit check, etc.

With pre-approval, you will really feel ready to make an offer when a home feels right, and if there’s heavy competition. You’ll also know exactly what you can afford, which is really the most important thing.

Ignoring Old Paint

Despite the fact that sellers are required to fill out a lead-pair disclosure form in most states, if the home you’re considering was built before 1978, you should seriously consider its potential for lead-based paint. On one of your showings, take a lead-paint test kit with you to swab a few areas that seem suspicious (flaking, zebra-like chips). I

Skipping the Final Walk-Through

Most purchase agreements allow for a final walk-through of the property to ensure that the house is still in good condition. This is especially true if you’re purchasing a foreclosed property. Beyond that, things can get banged up as people move out or repairmen get careless with any fixes requested as part of the purchase, so you’ll want to ensure that no last-minute damage was done.

The Commute is Too Long

At a certain point, a commute becomes a burden. If your commute is taking valuable time away from your family or personal goals, look for a home closer to your work. It may be worth it to downsize to a smaller home instead of losing too many hours out of every workday.

Roof Leaks

Home inspectors can find a lot of things wrong with a house but they can’t catch everything all the time. Most home inspectors won’t climb on a roof to inspect so it’s important to have things they won’t always check thoroughly viewed by an expert. A leak could be a sign that the roof needs to be replaced, which can be an expensive job.

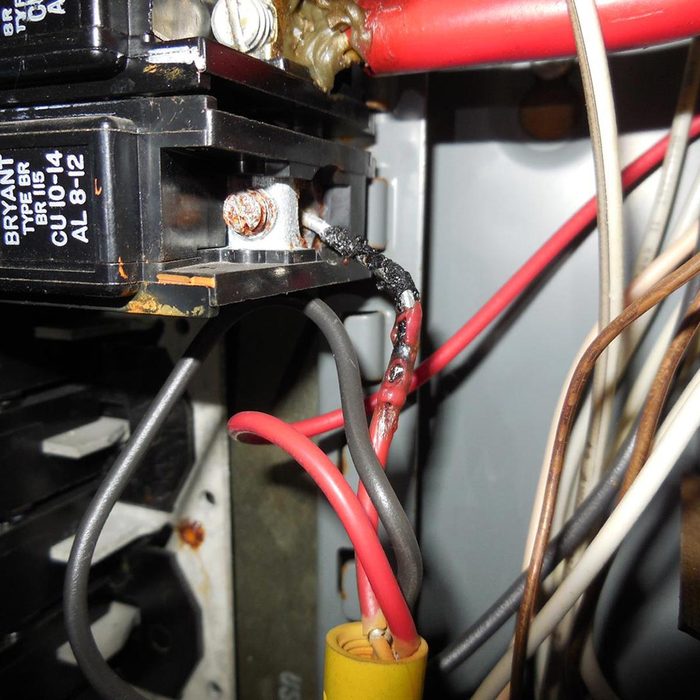

Check for Old or Damaged Wiring

Homes built in the mid-’60s or ’70s might have aluminum wiring and if so it should be determined if everything has been retrofitted properly. If it hasn’t, it could be a fire hazard and wiring replacement can run thousands of dollars.

Not Saving Enough Money

A NerdWallet survey of 2,200 home buyers and mortgage applicants found that the biggest regret for millennial buyers was they wished they’d save more money before buying a house. Saving money is especially important for having enough to make a reasonable down payment. Plus, it’s important to have some funds socked away for after you move into a new home to help take care of the inevitable expenses that will occur. In that same survey, more than 10 percent of respondents no longer felt financially secure after they bought their home. This is our take on how long it takes to save for a house.

Not Doing Enough Research

There are lots of things to consider when buying a house. Nearly half of the respondents in the survey mentioned above said they’d do something different if they could. Near the top of the list of things they’d do better the second time was doing more research. A total of 41 percent of people who applied for a mortgage felt they weren’t aware of all of their loan options. Many first-time homebuyers aren’t aware of all of the costs associated with buying a house, especially the closing costs.

Wrong Size Home

Nearly 20 percent of millennial buyers and 20 percent of Generation X buyers said they regretted they didn’t buy a bigger house in the NerdWallet survey.